Coastal and maritime tourism dominates the EU Blue Economy, driving significant economic growth and employment. The industry generates the largest GVA (32.7% of the whole EU Blue Economy) and employs the largest share of workers (53.1%).

This is largely due to the popularity of European coastal areas (Figure1) among tourists, both from within the continent and globally. A notable indicator of this trend is that, as of 2023, a substantial 42% of the EU's total bed capacity is concentrated in coastal areas, consistent with the preceding year. Coastal regions' pronounced appeal to tourists is also shown in Eurostat data looking into the features of a destination that attracted tourists to go there. In 2022, EU residents made 920 million tourism trips to destinations in the EU, for nearly 30% of those trips the coastal aspect was a decisive element.

Note: based on GEOSTAT population grid from 2011, additional data from Columbia University, Center for International Earth Science Information Network – CIESIN (2015): GHS population grid, and NUTS 2016.

In 2023, more than 1.4 billion nights were spent at tourist accommodation establishments (i.e. hotels, holiday and other short-stay accommodation, camping grounds, recreational vehicle parks and trailer parks) in coastal regions, a 6.4% increase from the previous year and above the 2019 peak (+3.5%).

The map is based on GEOSTAT population grid from 2011, with additional data from Columbia University, Center for International Earth Science Information Network – CIESIN (2015): GHS population grid, and NUTS 2016.

Coastal regions are defined according to one of the following three criteria:

- any NUTS level 3 region with a sea border;

- any NUTS level 3 region that has more than half of its population within 50 km of the coastline, based on population data for 1 km² grid cells;

- the NUTS level 3 region for Hamburg in Germany.

The country that attracted the most visitors was Spain with 363 million, followed by Italy at 238 million and France at 163 million (see Table 1). These countries are also among those with the longest coastlines in EU.

| TOTAL | Non-coastal areas | Coastal areas | Cities in coastal areas | |

| Belgium | 44,696,602 | 82% | 18% | 2% |

| Bulgaria | 26,865,046 | 42% | 58% | 17% |

| Czechia | 55,842,471 | 100% | 0% | 0% |

| Denmark | 38,946,106 | 8% | 92% | 38% |

| Germany | 431,439,035 | 81% | 19% | 5% |

| Estonia | 6,374,862 | 23% | 77% | 48% |

| Ireland | 40,636,150 | 26% | 74% | 29% |

| Greece | 147,209,821 | 4% | 96% | 10% |

| Spain | 484,987,486 | 25% | 75% | 25% |

| France | 460,271,796 | 65% | 35% | 6% |

| Croatia | 92,341,148 | 8% | 92% | 8% |

| Italy | 447,170,049 | 47% | 53% | 19% |

| Cyprus | 15,636,125 | 3% | 97% | 11% |

| Latvia | 4,370,854 | 21% | 79% | 53% |

| Lithuania | 8,473,828 | 72% | 28% | 5% |

| Luxembourg | 3,485,954 | 100% | 0% | 0% |

| Hungary | 30,488,308 | 100% | 0% | 0% |

| Malta | 9,892,292 | 0% | 100% | 53% |

| Netherlands | 142,272,461 | 56% | 44% | 21% |

| Austria | 127,765,910 | 100% | 0% | 0% |

| Poland | 92,797,861 | 76% | 24% | 4% |

| Portugal | 84,886,830 | 16% | 84% | 44% |

| Romania | 29,205,568 | 82% | 18% | 5% |

| Slovenia | 16,102,802 | 81% | 19% | 0% |

| Slovakia | 14,359,854 | 100% | 0% | 0% |

| Finland | 22,832,061 | 61% | 39% | 27% |

| Sweden | 63,896,119 | 37% | 63% | 33% |

| EU-27 | 2,943,247,399 | 52% | 48% | 14% |

Source: Eurostat tour_occ_ninatdc

In the same year, the majority of tourism in coastal areas, 57%, was driven on average by foreign residents, reporting an increase of almost 3% on the previous year2. However, large differences emerge when looking at Member State level, with some countries able to attract more than average foreign residents. The highest shares of foreign tourists in coastal areas are recorded by Cyprus (94%), Croatia and Malta (93%), and Greece (86%). Conversely, the lowest shares are reported in Romania (3%), Germany (7%) and Lithuania (15%).

The Coastal tourism sector comprises recreational activities taking place in proximity of the sea (e.g. beach-based tourism, coastal walks, wildlife watching) as well as those taking place in the maritime area, including nautical sports (e.g. sailing, scuba diving, cruising, etc.).

![[Bathing boxes on the beach]](https://blue-economy-observatory.ec.europa.eu/sites/default/files/styles/oe_theme_medium_no_crop/public/2022-04/AdobeStock_5838556.jpeg?itok=vjl0yWvS)

The socio-economic statistics presented in this section originate from three typologies of activities typically undertaken by tourists as reported by EU Member States, attributed to coastal areas on the basis of a specific computation methodology:

- Accommodation, i.e. nights spent at tourist accommodation establishments in coastal areas;

- Transport, reflecting the maritime proportion of sea-borne, road, rail and air passenger travel;

- Other expenditures, covering specific tourist expenditures in coastal areas (e.g., food & beverage services, cultural and recreational goods, purchase of water-sport equipment and clothing, etc.).

Size of the EU Coastal Tourism

In 2022, the coastal tourism sector recorded a performance similar to pre-COVID-19 level. The GVA generated by the sector amounted to EUR 82.0 billion, up from EUR 50.7 billion registered in 2021, i.e., a year-on-year 62% increase, and above the pre-COVID-19 level (EUR 81.0 billion in 2019). Gross profits, at EUR 30.3 billion, 84% increase compared to 2021. The sector’s turnover resulting from the aggregation of the abovementioned sub-sectors amounted to EUR 238.0 billion (Figure 2).

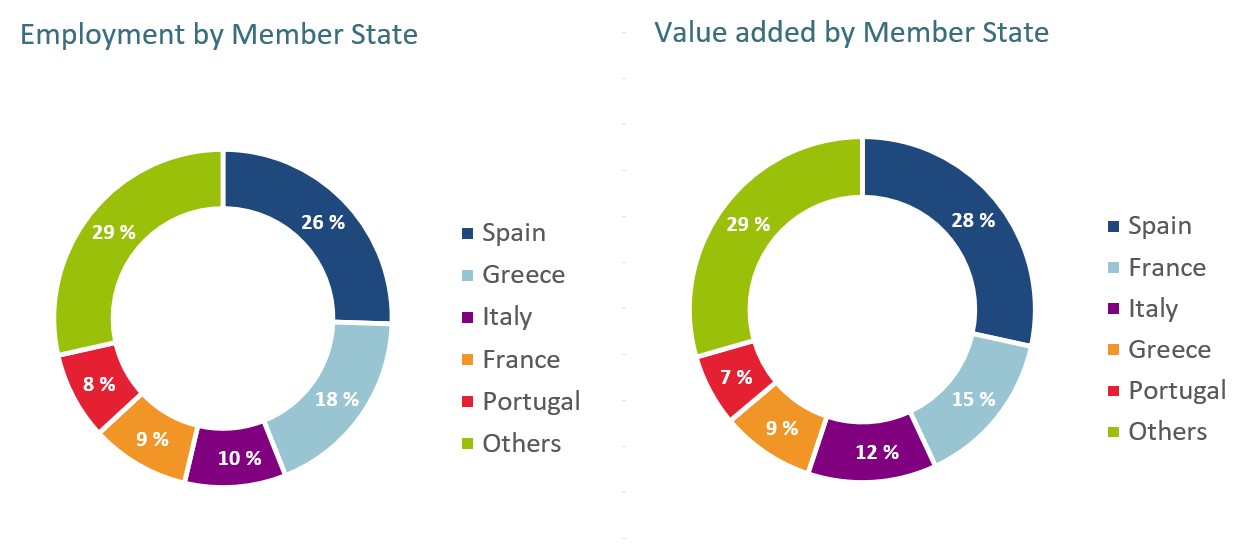

In 2022, Spain led the Coastal tourism sector in terms of employment contributing with 26% of jobs, followed by Greece with 18%, France with 10% and Italy with 9% (Fig. 3). The sub-sector Accommodation employed 1 086 100 persons, accounting for about 44% of the jobs; while about 1 125 200 persons (42%) were employed in Other services (e.g. restaurants), and about 348 900 persons (14%) were employed in Transport.

In terms of GVA, Spain led with 28%, followed by France with 15%, and Italy with 12% in 2022. The sub-sector Accommodation generated EUR 42.4 billion in GVA, about 52% of the sector’s GVA, while Other services generated EUR 25.1 million (31%) and Transport EUR 14.5 million (18%).

A few years after the COVID-19 pandemic, the industry has fully recovered in most EU regions, with coastal tourism showing greater resilience than urban and rural destinations, having been less impacted by the crisis. Several noteworthy trends are currently emerging in the tourism sector, with sustainable tourism and digitalisation being particularly significant ones. To this end, the EC published the Transition Pathway for Tourism, a framework designed to create a more sustainable and resilient tourism ecosystem in the EU, through a green and digital transition. As part of the Transition Pathway for Tourism, the EC developed the EU Tourism Dashboard, an online knowledge tool to monitor indicators measuring the green, digital and socio-economic aspects of tourism. The EU Tourism platform was also developed as a one-stop shop for all tourism stakeholders to follow the progress of transition pathway. Finally, climate change is projected to have a profound impact on the coastal tourism sector, posing significant challenges to the industry's sustainability and resilience. Rising global temperatures, sea-level rise, and increased frequency of extreme weather events will alter the physical environment, ecosystems, and amenities that underpin coastal tourism. Unbalanced tourism has also re-emerged in some destinations which has been further exacerbated by climate change.

Sustainable tourism has become a critical priority for coastal destinations in the EU, as the industry seeks to balance economic growth with environmental and social responsibility. It presents a dual opportunity: first, it enables the sector to contribute to the transition towards a greener economy, aligning with global efforts to mitigate environmental degradation. Second, embracing sustainable tourism practices can yield significant benefits for the industry itself, given its intrinsic dependence on the preservation of natural resources. Many tourism activities, such as swimming, snorkelling, and hiking, rely on clean seas, pristine landscapes, and intact ecosystems. This underscores the vital role of environmental conservation in ensuring the long-term viability of the tourism sector.

The demand for sustainable tourism is rising, as evidenced by numerous academic and industry surveys. A Eurobarometer survey on the attitudes of European tourists revealed that 43% of travellers consider the natural environment a key factor when choosing their destination, while 82% of respondents are willing to adopt more sustainable practices. On the supply side, an increasing number of businesses, including small and medium-sized enterprises, recognise the importance of sustainability and seek formal recognition for their efforts. The EU Ecolabel, a mark of environmental excellence awarded by the European Union, or other EN ISO 14024 Type I ecolabels, serve as instruments to support this transition. The competitiveness of the EU tourism industry will largely depend on its ability to align with these evolving consumer expectations and sustainability requirements.

The European Agenda for Tourism 2030 also sets out a strategic vision for advancing the green transition of the tourism ecosystem, encompassing transport, attractions, and hospitality services. It encourages the creation of conditions and incentives to enhance the circularity of tourism services, including waste management, water conservation, and energy efficiency. To this aim, the EU provides funding for projects in different areas, including the Mediterranean basin and the outermost regions. Many EU coastal destinations, such as the Greek island of Lesvos, are already implementing sustainable tourism practices, demonstrating how the sector can contribute to both environmental stewardship and socio-economic resilience. More than 50 pledges by stakeholders towards the green transition can be found in relation to coastal and maritime tourism on the EU Tourism Platform.

Digitalisation is a key driver of competitiveness and sustainability in the EU's coastal tourism sector. The Transition Pathway for Tourism identifies digitalization as a major opportunity for growth and highlights areas where improvement is needed. Specifically, it emphasizes the importance of technical implementation for a tourism data space, as well as research and investment in innovative digital tools such as virtual reality, augmented reality, and artificial intelligence. Furthermore, raising awareness among small and medium-sized enterprises (SMEs) about the benefits of digitalisation is crucial, as it can help them leverage technology to enhance their operations, improve customer experiences, and stay competitive in the market.

The increasing prevalence of digitalisation is already significantly impacting the tourism industry, giving rise to a new paradigm in business operations. A key aspect of this trend is the growing reliance of tourists on online platforms and mobile applications to facilitate various aspects of their travel planning, including searching, comparing, booking destinations, activities and experiences to enjoy at their chosen location, interacting with businesses in real time, accessing personalised recommendations, as well as sharing experiences through digital channels.

The tourism industry is undergoing a significant transformation as digital technologies become central to business strategies. From a supply-side perspective, this shift towards digitalisation is driving a transformation in business models, with a greater emphasis on digital presence, online reviews, and sponsored content as key components of marketing strategies. Businesses must adapt to this digital landscape by leveraging data analytics, artificial intelligence, and targeted advertising to enhance customer engagement and competitiveness. In this evolving environment, digital technologies are redefining the way tourism businesses operate, interact with their customers, and ultimately, deliver their products and services.

Climate change is projected to have a profound impact on the coastal tourism sector, posing significant challenges to the industry's sustainability and resilience. Rising global temperatures, sea-level rise, and increased frequency of extreme weather events will alter the physical environment, ecosystems, and amenities that underpin coastal tourism. The erosion of beaches and coastal infrastructure is a major concern, as sea-level rise and increased storm intensity will lead to the loss of tourist facilities, such as hotels, restaurants, and recreational areas. Furthermore, the decline or loss of iconic attractions, such as coral reefs, can have a notable impact on the industry.

In addition to these physical changes, coastal tourism destinations will also face a heightened risk of extreme weather events, such as hurricanes, storms, and floods. These events can damage infrastructure, disrupt tourism activities, and pose a threat to visitor safety, ultimately affecting the reputation and attractiveness of these destinations. Changes in water quality and temperature will also have a significant impact on the industry, as decreased water quality and increased risk of water-borne illnesses will make it difficult for tourists to engage in water-based activities.

A study on the regional impact of climate change on European tourism demand has shed light on the potential effects of a warmer climate on tourist flows. The study, which simulates future impacts up to the year 2100, reveals that under a scenario of a 1.5°C temperature increase, only 20% of European regions will be minor affected, with tourist numbers remaining relatively stable (changing by -1% to +1%). However, under a high-emission scenario, the consequences are more pronounced. Certain coastal regions will be particularly hit hard, with the Greek Ionian Islands expected to experience a 9.12% decline in tourist numbers. Additionally, several other popular destinations, including Cyprus, Spain, Italy, and Portugal, can expect to lose around 5% of their tourist traffic.

The consequences of the climate change will be far-reaching, and will not affect only the tourism industry but also the livelihoods of communities that depend on coastal tourism. The economic losses resulting from damage to infrastructure, loss of revenue, and decreased visitor numbers will be significant, and the job losses and community disruption that follow will have a lasting impact on the social fabric of these communities.

To mitigate these impacts, promoting sustainable tourism practices, such as eco-tourism and responsible travel, can help reduce the industry's carbon footprint and support climate change mitigation. In the short-term, investments in infrastructure, such as sea walls, dunes, and green roofs, are necessary to protect tourist facilities and amenities. Furthermore, developing and implementing climate change adaptation and resilience plans, including early warning systems and emergency response plans, is also crucial for minimising the risks associated